Make every conversation count

Empower every agent. Improve every outcome. Increase every conversation’s value, with MaxContact’s AI-powered Customer Engagement platform built for commercial impact.

discover the latest

client stories

2025/26 UK Contact Centre KPI Benchmarking Insights Report

A comprehensive benchmark of key contact centre metrics and insights, providing the context needed to set realistic, competitive performance targets.

.avif)

The Voice of the UK Consumer: What Customers Really Want from Contact Centres

This report shares our key findings and practical recommendations, and is designed to help you align technology and empathy to deliver excellence for the modern customer.

discover the latest

client stories

Redwood Group Triples Revenue with Automated Dialling

Redwood Group needed to replace their manual dialling processes with an automated solution that could support their ambitious growth targets. They partnered with MaxContact to implement a comprehensive dialler system.

We Finance Any Car: Smarter Dialler, Better Sales

We Finance Any Car, an online car finance brokerage, needed a reliable contact centre solution that could scale with their rapid growth. They also needed support and accountability that their previous provider had failed to deliver.

Honey Group - Foundation for future growth

Estate planning and wealth management experts, Honey Group, were frustrated as their previous system couldn’t keep up with increased data volumes resulting in CRM integration issues and an overall lack of efficiency that impacted productivity. MaxContact’s solution has provided them with the scalability and agility they need to succeed now, and in the future.

FREQUENTLY ASKED QUESTIONS

Frequently asked questions ordered by popularity. Remember that if the visitor has not committed to the call to action, they may still have questions (doubts) that can be answered.

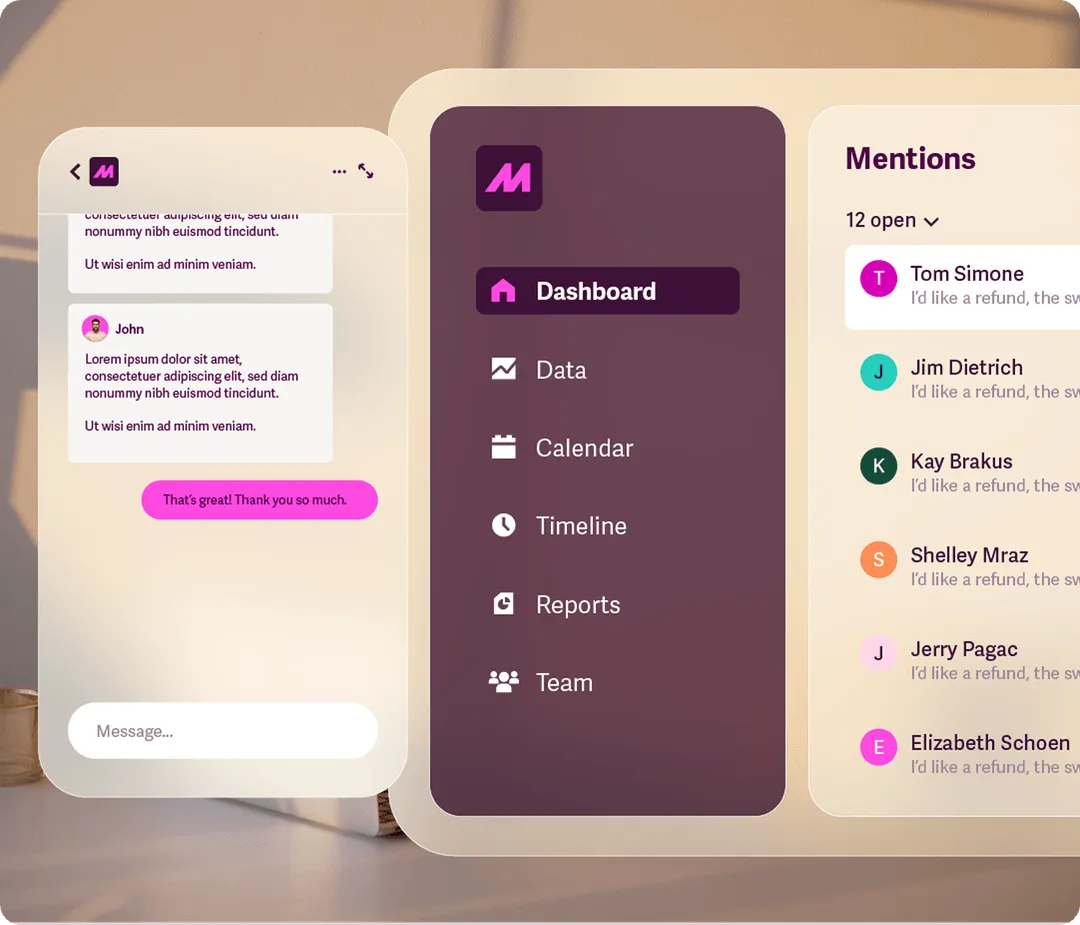

Enhanced Omnichannel

When digital and voice channels operate independently, teams lose context. Enhanced Omnichannel focuses on breaking down the separation between channels, so actions taken in one place can influence outcomes everywhere else. This improves routing decisions, reduces duplicated effort, and gives agents a clearer view of the full customer journey.

The work centres on unifying new and existing capabilities around a single omnichannel architecture, with workflow and AI at the core. Voice and digital interactions are no longer treated in isolation - dispositions, attempt counts and outcomes can be shared across channels, and agents can handle digital and outbound voice concurrently.

Digital Interaction Routing and Response

Digital interactions often wait in queues before anyone knows what they’re about - leading to slow responses and unnecessary hand-offs. Digital Interaction Routing and Response helps teams evaluate digital contacts as soon as they arrive, improving speed, accuracy and customer experience.

Simple queries can be resolved immediately, while more complex ones reach the right agent first time. As digital messages arrive - including email, SMS and messaging channels - workflows automatically assess intent. Straightforward enquiries can be handled with automated AI responses, while others are intelligently routed into the most appropriate queue based on context and need.

This reduces handling time, prevents mis-routing, and brings the same intelligence to digital channels that teams expect from voice.

Real-Time Agent Assist

Post-call feedback comes too late to change outcomes. Real-time AI assistance helps agents do the right thing in the moment, improving accuracy, confidence and compliance. Handling time drops and customer experience improves - especially in complex or regulated scenarios. The feature surfaces live guidance, disclosures, next-best actions and knowledge based on real-time intent and context.

Cross-Channel AI Agents

Customers don’t always stick to one channel - and automation that only works in silos quickly breaks down. Cross-Channel AI Agents extend AI handling beyond voice and web chat, helping teams engage consistently across SMS, WhatsApp, Meta and email, even when conversations are asynchronous. This reduces missed messages, improves response times, and ensures customers get a coherent experience wherever they continue the conversation.

This capability expands existing AI Agents to operate across digital channels, allowing conversations to pause and resume naturally while maintaining context. AI Agents can handle clearly defined interactions end-to-end where appropriate, or pass conversations to humans with full history when needed, ensuring continuity across voice and digital touchpoints.

New Look Dashboards (Discovery)

Leaders often struggle to turn dashboards into decisions, spending too much time interpreting data instead of acting on it. New Look Dashboards is focused on exploring how insight can be made clearer, more intuitive and easier to navigate, so performance issues and trends are easier to spot without deep analysis. The goal is to reduce cognitive load and make every day insight more usable for operational decision-making.

This initiative is currently in discovery and design, testing different approaches to layout, visualisation and interaction to understand what genuinely helps users find and act on insight faster. This work will inform future dashboard improvements, ensuring any changes are grounded in real user needs and measurable value.

Enhanced Dashboard Management

When dashboards are hard to publish, share or find, insight gets buried and teams lose confidence in what they’re seeing. Enhanced Dashboard Management simplifies how dashboards are published, accessed and organised, so leaders can focus on using insight - not managing software. Teams spend less time duplicating dashboards or working around permissions, and more time acting on a single, trusted view of performance.

This update removes the dependency on permission groups as a workaround for dashboard sharing, allowing dashboards to be published directly to one or many permission groups with clear access control. It also eliminates the artificial split between dashboards and wallboards, reducing duplication and confusion. New navigation and folder-based organisation make dashboards easier to find, manage and maintain day to day - aligned to user expectations and the platform’s long-term permissions model.

.png)