Transform Payments & Collections with AI Agents

Turning every interaction into a recovery opportunity with intelligent AI agents that handle payment and collections conversations naturally, whilst your team focuses on complex cases.

Scale Recovery Operations Whilst Controlling Overheads

AI agents handle high-volume payment and collections calls 24/7, turning every conversation into a recovery opportunity. Manage growing collections portfolios whilst controlling operational costs as your team focuses on complex negotiations that drive real value.

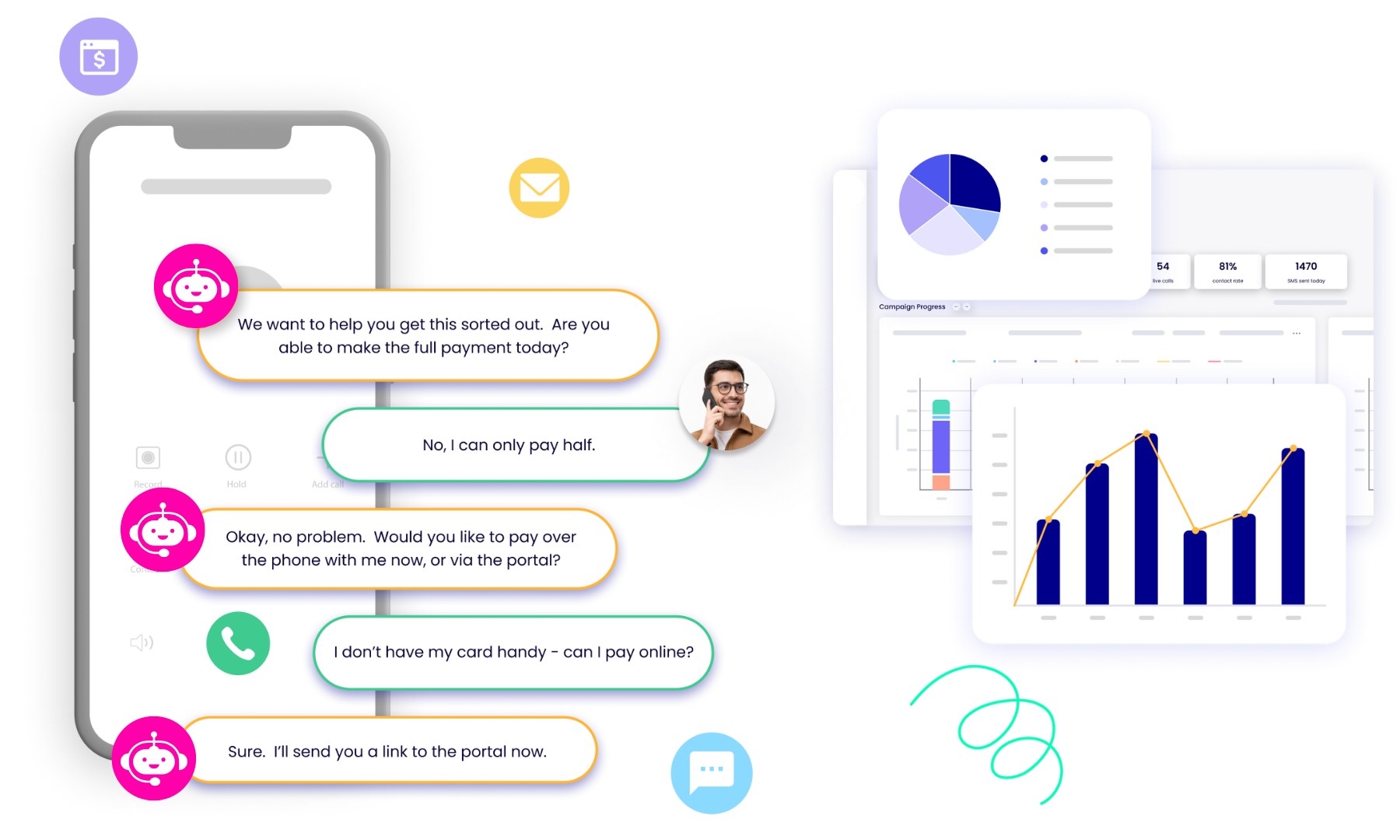

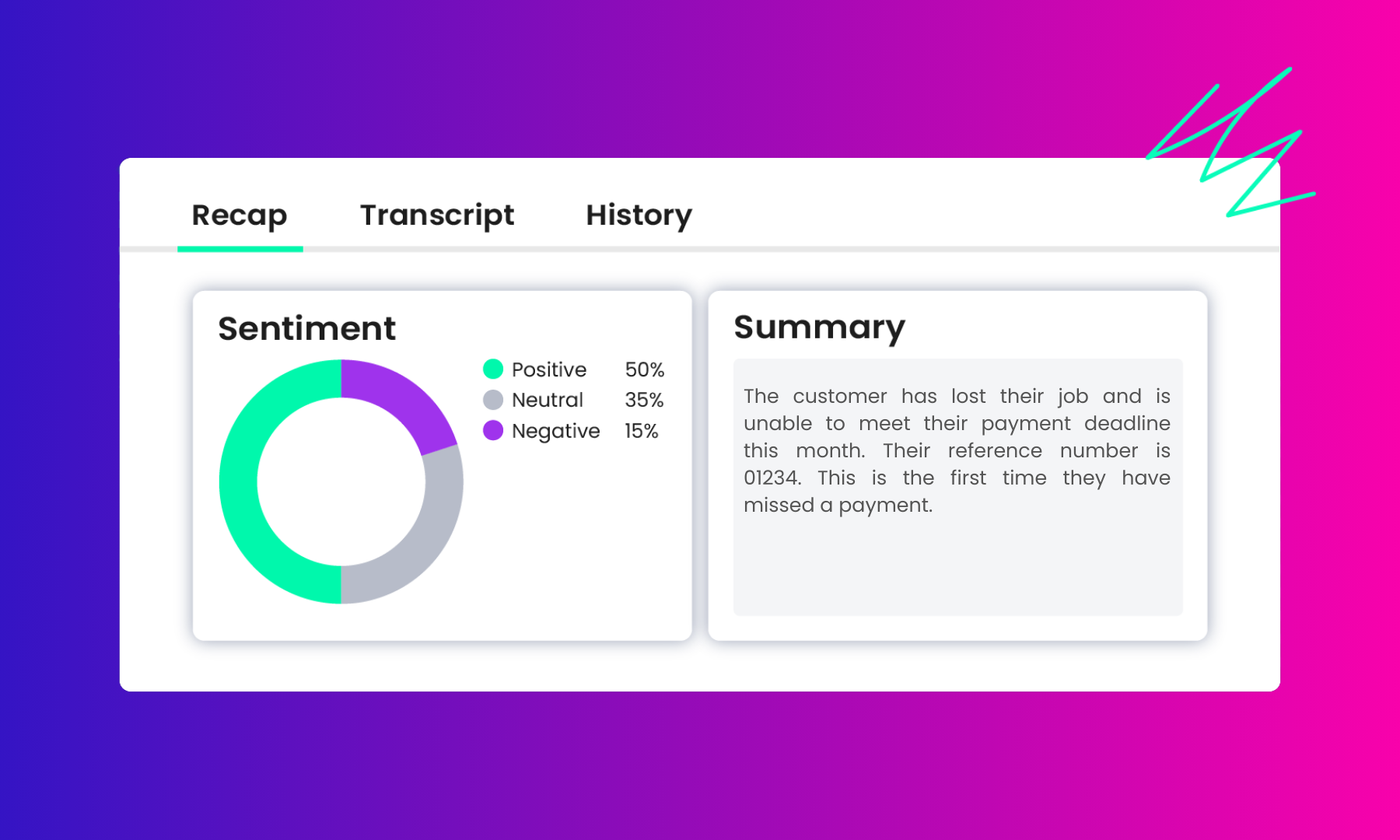

Empathetic Conversations with Intelligent Escalation

Natural language processing delivers context-aware interactions that maintain trust throughout the payment and collections processes.

With seamless handoffs to human agents when complex situations require personal attention, with complete conversation context.

Compliant Recovery at Scale

Built-in compliance controls ensure every interaction meets FCA Consumer Duty requirements.

Automated vulnerability detection, clear audit trails, and intelligent escalation pathways protect both customers and your reputation.

Trusted by Debt Recovery Professionals

AI call containment achieved

AI agents handle payment reminders and arrangement discussions without human escalation

Payment plan acceptance rates

Flexible repayment options handled automatically with empathetic conversation management

AI Agents Built for Payments & Collections

Each AI agent specialises in specific debt collection scenarios, delivering consistent, compliant outcomes across your entire portfolio.

First Contact & Account Tracing

Handles initial debt recovery calls, account verification, and right party contact confirmation. Professionally explains debt situations, confirms customer details, and establishes payment dialogue whilst maintaining compliance with treating customers fairly principles.

Automated Payment Reminders

Delivers consistent payment reminders via phone. Processes immediate payments via SMS link, explains payment options, and follow-up actions based on customer responses and payment history.

Round-the-Clock Payment Solutions

Available whenever customers are ready to pay, processing secure payments outside business hours. Handles payment arrangements and provides payment confirmations with full PCI compliance.

Flexible Repayment Solutions

Assesses customer circumstances and offers tailored payment plans within your business rules. Captures affordability information, calculates sustainable payment schedules, and secures customer commitment to repayment agreements.

Initial Dispute Management

Identifies potential vulnerability indicators and applies appropriate support measures. Immediately escalates to trained human specialists when customers show signs of mental health issues, financial abuse, or other vulnerabilities.

Simple to deploy. Powerful when you need it.

Deploy AI agents across your debt portfolio in weeks, not months. Start with basic workflows and scale complexity as your confidence grows.

Multi-Portfolio Deployment

Deploy AI agents across different debt types – consumer credit, utilities, telecommunications, and secured lending – with portfolio-specific training and compliance requirements.

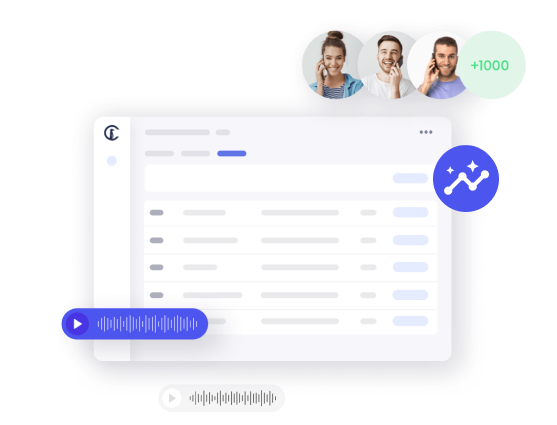

Human Handoffs

AI agents handle routine recovery calls professionally – clearly identifying as digital assistants, not pretending to be human. When situations require human expertise or empathy, intelligent routing ensures seamless transfer to the right specialist.

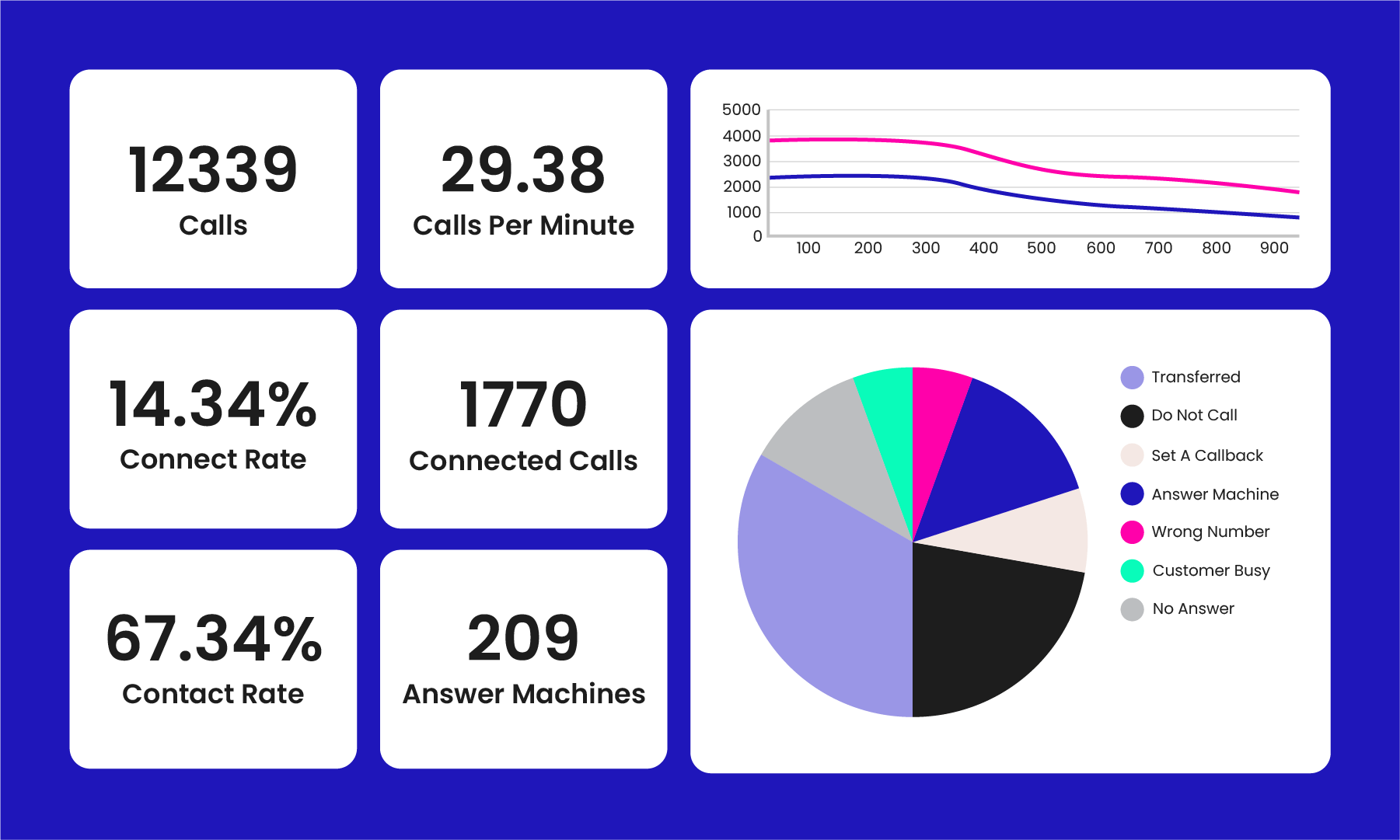

Indepth Analytics

Comprehensive dashboards track payment rates, promise-to-pay conversions, and customer satisfaction across all AI interactions with actionable insights for portfolio optimisation.

Recovery Strategies

Configure recovery strategies, payment thresholds, and escalation rules specific to different debt types, with full conversation transcripts and performance optimisation capabilities.

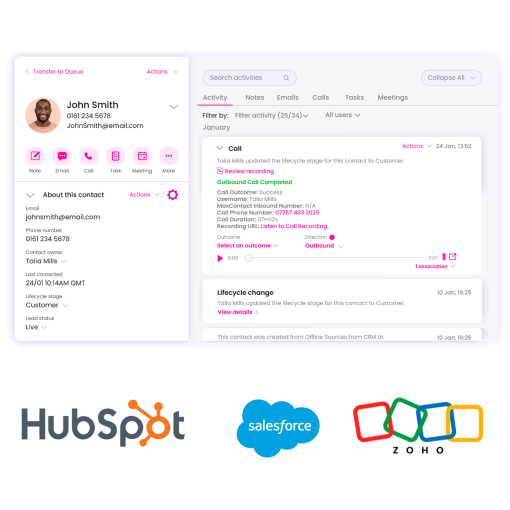

Built for Your Existing Tech Stack

Seamlessly integrate with debt management systems like Qualco, CRM platforms such as Orca, and telephony infrastructure through comprehensive APIs and pre-built connectors. MaxContact’s unified platform approach ensures consistent data flow and operational efficiency across your entire recovery operation.

The MaxContact Difference

Ready to transform your debt recovery operations with AI agents that deliver results whilst maintaining compliance and customer satisfaction?

- No data silos or disconnected systems

- Complete visibility of customer journey

- Ongoing support from people who understand your business

- Peace of mind with data security and privacy

Join leading UK organisations already benefiting from MaxContact’s AI Agent solutions. Our team is ready to show you how they can work for your specific business needs.

Frequently Asked Questions

Everything you need to know about deploying AI agents in debt recovery operations, from compliance requirements to performance metrics.

Which debt collection scenarios work best for AI agents?

AI agents excel in payment reminders, account verification, simple payment arrangements, and routine enquiries. They’re particularly effective for high-volume early-stage recovery where consistent messaging and 24/7 availability drive better contact rates. Complex negotiations, vulnerability cases, and dispute resolution require human expertise, with AI providing complete conversation context for seamless handoffs.

How do AI agents maintain compliance with FCA Consumer Duty?

Our AI agents are built with Consumer Duty principles embedded throughout. They automatically detect vulnerability indicators, apply treating customers fairly protocols, maintain comprehensive audit trails, and escalate appropriately when situations require human intervention. All interactions are recorded and monitored for compliance with clear documentation of decision-making processes.

What happens when AI agents encounter vulnerable customers?

AI agents are trained to recognise potential vulnerability indicators through conversation patterns, payment history, and explicit customer statements. When vulnerability is detected, calls are immediately escalated to trained human specialists with complete conversation context, ensuring appropriate support whilst maintaining compliance with regulatory requirements.

How quickly can we see ROI from AI agents in debt recovery?

Most debt recovery operations see measurable improvements within 4-6 weeks of deployment. The combination of increased contact rates, 24/7 availability, and automated payment processing typically delivers positive ROI within the first quarter, with continued improvements as AI agents learn from successful interactions.

Can AI agents handle payments securely?

Our AI agents maintain full PCI DSS compliance for payment processing, with enterprise-grade security for all customer data handling. They can securely process card payments, set up direct debits, arrange payment plans, and handle sensitive financial information whilst providing comprehensive audit trails for regulatory compliance.

How do AI agents maintain your brand voice in debt recovery?

AI agents are trained specifically on your brand guidelines, tone of voice, and debt recovery approach. They learn from your existing successful interactions and can be fine-tuned to match your organisation’s communication style, whether that’s formal and professional or more conversational and supportive, ensuring consistency across all customer touchpoints

What performance metrics can we track for AI debt recovery agents?

Comprehensive analytics track Right Person Connect rates, payment completions, promise-to-pay conversion rates, customer satisfaction scores, complaint rates, and cost per successful recovery. Real-time dashboards provide visibility into AI performance across different debt types, customer segments, and time periods with detailed reporting for continuous improvement.