Outbound dialling and self serve contact centre software for debt collection

Increase collection rates by connecting to the right person more often while maintaining compliance and offering self serve options.

Improve Debt Collection rate with Contact Centre Software

Our call centre software solutions help credit and debt collection teams accelerate recoveries. Speak to clients more often. Text them reminders. Offer self-serve. Give your customers choice and watch collection rates soar.

Cost Per Collect

Reduce the amount of interactions needed to resolve debt

Average Handle Time

With canned responses and bespoke scripting you can reduce AHT

Right Party Contact

Improve RPC Rate with our un-droppable algorithm and advanced dialling methods

First Contact Resolution

Measure your FCR rate and improve with Spokn AI (Speech Analytics) to improve agent performance.

What our clients have to say about MaxContact…

Marston Holdings provides end-to-end transportation services across the UK, including consultancy, traffic technology, parking management, enforcement, and debt recovery for 280 local authorities and government departments.

This case study focuses on Marston’s Business Process Outsourcing (BPO) division, which operates contact centres collecting debt on behalf of Local Authority Parking and Highways Departments.

Increase Success Rates With Advanced Outbound Dialling.

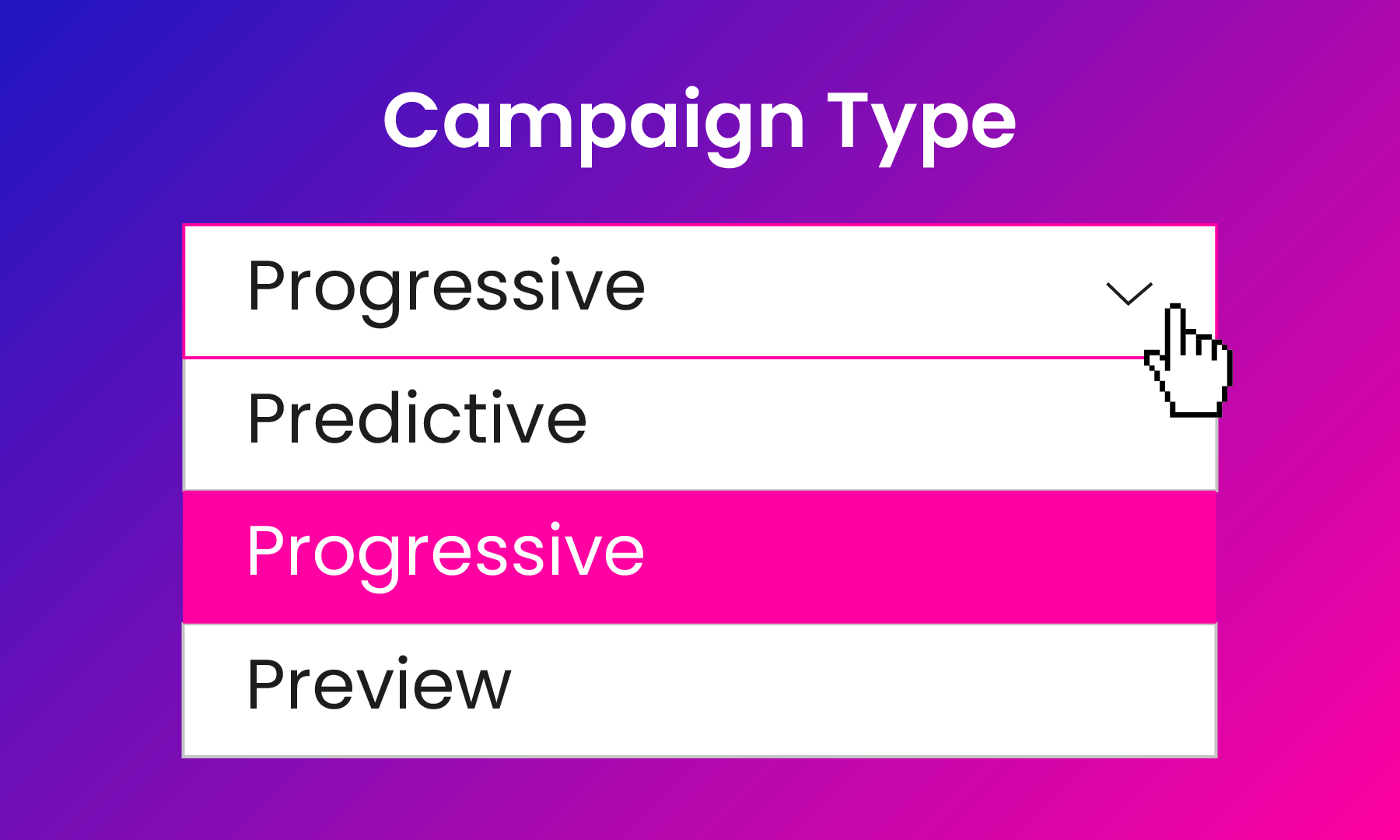

Predictive, Progressive & Preview Dialling

Our trio of quick-dialling capabilities combined with our un-droppable algorithm and answer machine detection are the foundations for successful campaigns.

Contact Prioritisation

Puts those important calls at the top of your list using custom data fetching on your leads.

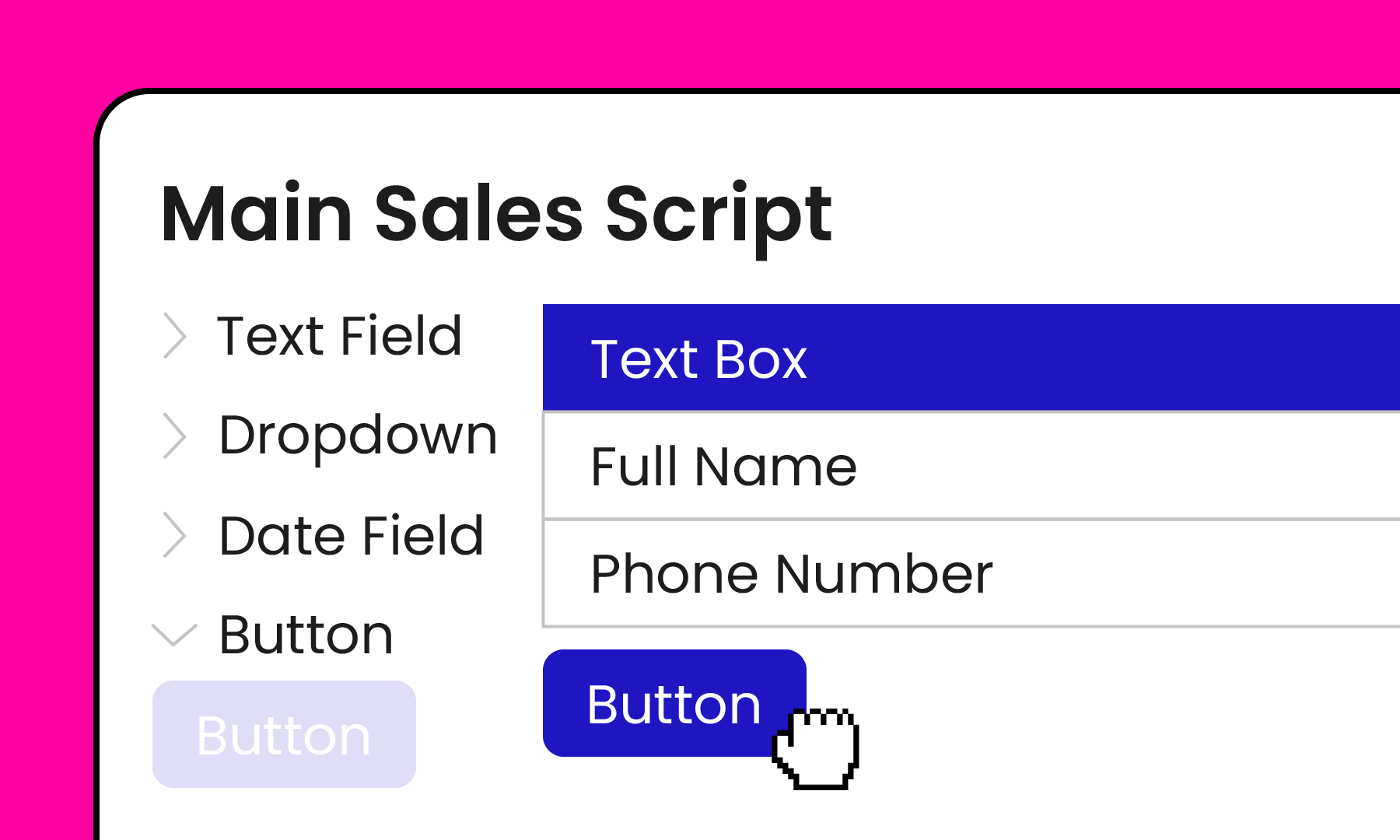

Successful Scripting

Made easy, with drag-and-drop functionality.

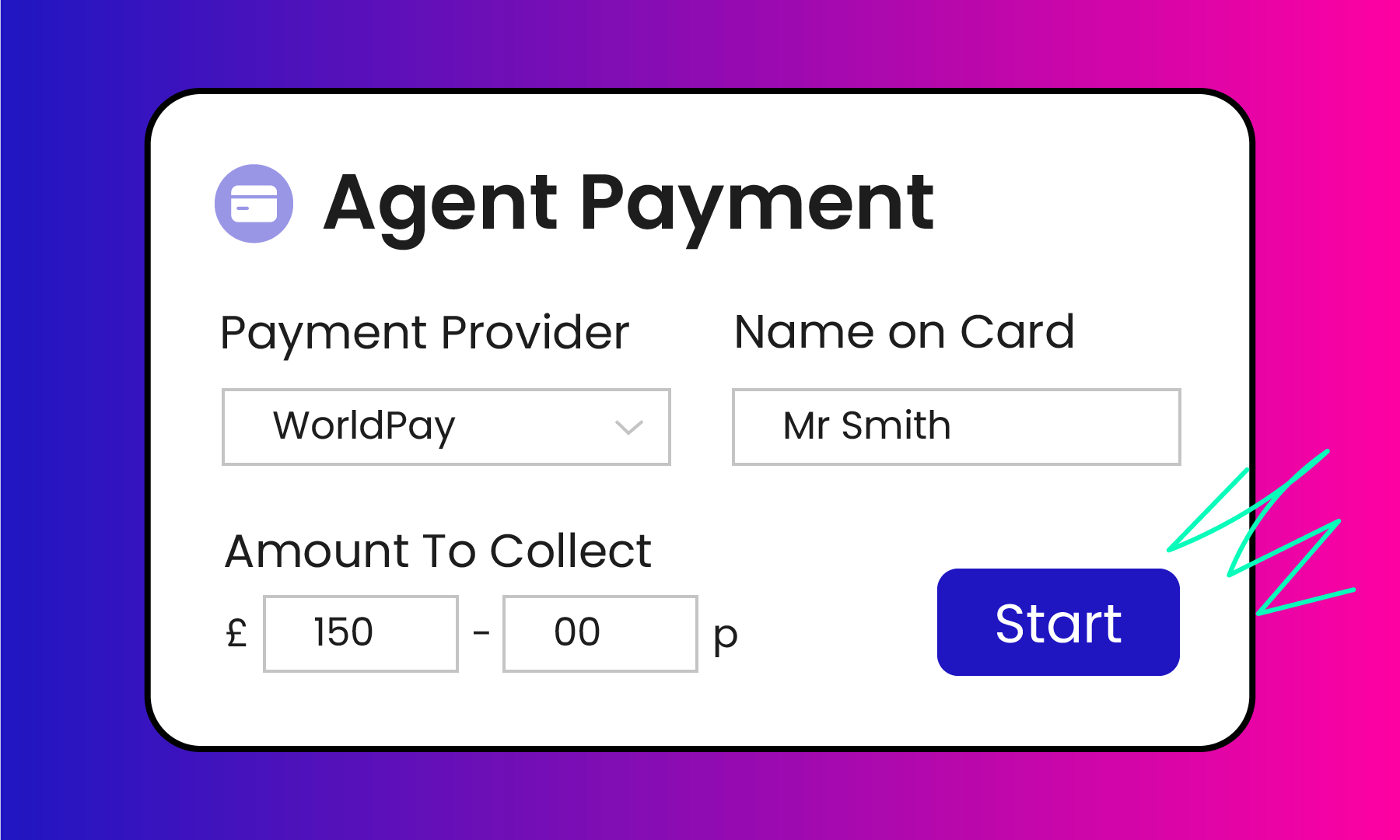

Compliant Payments

Take payments quickly and securely with PCI-DSS.

Core solutions

Secure Payment Solutions

Set up PCI-DSS compliant payment phone lines, take secure assisted payments, add the ability to pay online by link and automate payment workflows.

Omnichannel engagement platform

Provides multiple channels for reaching debtors.

Predictive Dialling & Do Not Call Compliance

Increases contact rates while adhering to regulations.

Improve performance

Real-time Agent Coaching & Call Monitoring

Improve collector communication skills and ensures compliance.

Spokn AI

Advanced Reporting & Analytics

Provides data-driven insights to optimise collection strategies.

Why you should work with us

Simple to get started

Whether it’s licensing, pricing or set-up, we’ll make it easy.

Built for you

We don’t do one size fits all, which is why we work with you to design a solution that fits your needs.

Supported

100% UK-based support team. 97% customer satisfaction rating. Feel supported at every step.

Features that deliver

To see how MaxContact’s engagement centre software can connect communications for your business, request your customised demo.

Debt Collection FAQs

What is a debt collection call centre?

A debt collection call center is a place dedicated to helping individuals resolve unpaid bills. Its team of agents specialises in understanding debt and working out solutions with people who might be behind on payments. These debts can be for many things, like credit cards, medical bills, or even past-due rent.

What is debt collection call centre software?

Debt collection call center software is a suite of tools designed to streamline the accounts receivable process for creditors and improve the customer experience for debtors.

What does debt collection software do?

- Enhanced Workflow Management: Software automates repetitive tasks like dialling, skipping busy signals, and leaving pre-recorded messages, freeing agents to focus on personalised communication with debtors.

- Omnichannel Communication: The software facilitates outreach through various channels, such as phone calls, emails, text messages, and even live chat, providing debtors with flexible options to connect and discuss their accounts.

- Secure Payment Processing: Integrated payment gateways allow debtors to settle their outstanding balances conveniently during a call or through a secure online portal.

- Regulatory Compliance Support: The software helps agents adhere to industry regulations by flagging potential compliance concerns and maintaining a detailed record of all debtor communication.

- Data-driven Insights: Real-time reports and analytics empower managers to monitor agent performance, identify trends in payment behaviour, and optimise collection strategies for improved recovery rates.

Debt collection call centre software fosters a collaborative environment where agents can efficiently manage accounts receivable, ensure regulatory adherence, and provide debtors with multiple avenues to resolve their outstanding obligations.