Contents

As the cost of living crisis continues and bills continue to soar, contact centres are facing an increase in vulnerable customers who are seeking support. Now more than ever, it’s crucial that these customers are able to easily receive the correct support and that contact centre teams are prepared for potentially difficult and distressing conversations.

Accessing adequate customer service is vital, especially during the cost of living crisis.

Being on the frontline of organisations, contact centre advisors see and hear the impact this is having on customers first. It’s important that agents have the right tools in place to effectively support vulnerable customers during these tough times without jeopardising their own wellbeing.

Identifying vulnerable customers

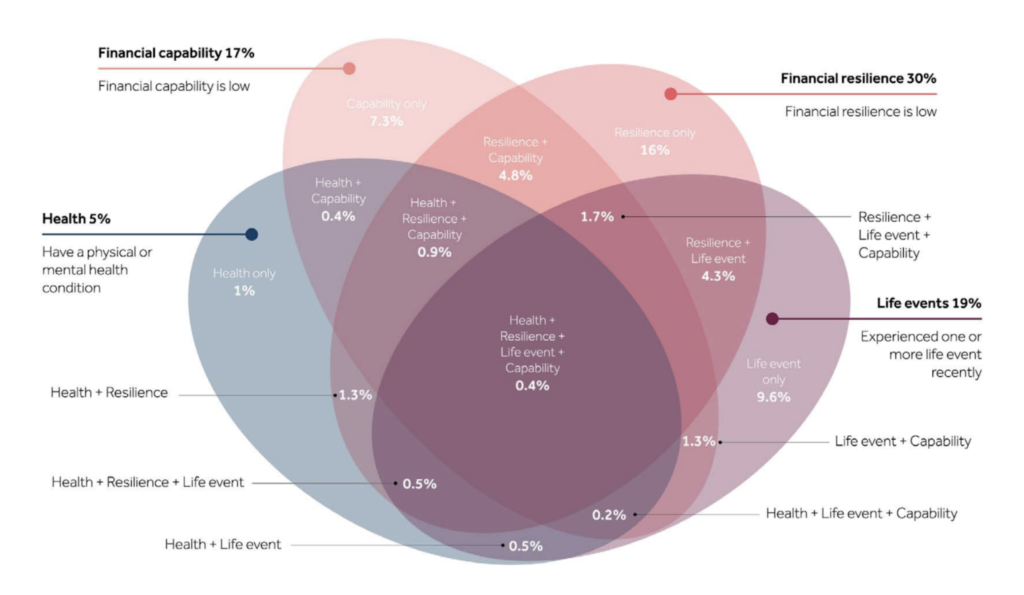

The FCA recently widened its definition of a vulnerable customer. While it includes more commonly known groups, such as the elderly and those with certain health conditions. It now also includes individuals that are sometimes more difficult to identify, like people with addictions, those who need care from others and those with low financial resilience.

That’s particularly important when you consider that, as the FCA survey shows, many more people have found themselves financially vulnerable, with a 15% rise in people feeling financially vulnerable since the start of the pandemic.

At the same time, the increase in the number of vulnerable people creates additional workload for companies that have a duty to identify them in their own customer base and during any sales process.

That’s important for businesses to know, but the fact is that it’s not always easy to identify vulnerable people from basic information provided on a form, or even during a phone call.

Despite recent progress, customers can sometimes still feel stigma around mental health, poverty and poor literacy levels. In fact, customers may be reluctant to bring up a host of issues that would identify them as vulnerable to your agents.

[Watch] How to identify and best serve your vulnerable customers in your contact centre >

Insights from our research

We recently worked on a comprehensive piece of research where we surveyed 1000 vulnerable UK people who’d had recent interactions with customer service support.

At a glance, we found that:

- 45% have struggled to get through to the right person or department when contacting customer service.

- 51% have been passed between different agents and had to re-explain their problem several times.

- 30% of respondents said that their finances were negatively impacted by the inability to contact a company’s customer service.

- 27% feel their needs are not being accommodated by customer service staff.

- 30% feel as though advisors are trying to get them off the phone quickly.

5 ways you can help vulnerable customers achieve good outcomes

In this guide, we share five practical ways your contact centre can support vulnerable customers during the cost of living crisis and beyond.

1. Learn from best practice – even if your sector is unregulated

As customer concerns rise, even those in unregulated sectors could face an influx of more challenging calls so it’s important that all businesses are prepared and know the best practices in order to support vulnerable customers through the tough times ahead.

Can you easily scale your support for vulnerable customers?

- There are currently 27.7 million vulnerable customers in the UK but this number is set to grow. Greater support will be needed from firms as the number of customers facing hardship rises.

- If all staff aren’t trained to deal with vulnerable customers, make sure they are able to spot signs that a customer is struggling and know the appropriate colleagues to pass them on to for support.

- Consider training wider agent teams so they can handle vulnerable customers and ensure teams have support when things get really busy, including breaks from emotionally intense work.

Utilise scripting – but cut canned responses

- Consider holding back from sending canned responses for these customers as they can easily be misconstrued and seem uncaring. Personalised responses are more appropriate for vulnerable customers as they may need more detail or clarity on discussion points.

- Instead, having a scripting guide for teams to follow gives them confidence and makes sure they are prepared for any jarring questions. It also makes sure customers feel valued and reassured that the company is doing the right thing

Check out our guide to writing effective scripts >

Always follow up on what is discussed with the customer

- For example, share affordability statements and plans via links in email or SMS and emphasise the purpose of this communication is to make sure that you come to a solution that is right for both the business and customer and to eliminate any repeat conversations in the future.

- This empowers the customer to feel they understand what is being asked of them and why and encourages an honest response.

2. Stay compliant with the FCA’s new Consumer Duty guidance

The current economic climate means that it’s crucial that customers are able to make good financial decisions. Our research shows that current customer service needs to improve to ensure vulnerable customers feel supported; 27% feel their needs are not being accommodated by customer service staff.

The FCA’s new Consumer Duty guidance will not only set higher and clearer standards of consumer protection across financial services, but it will also require firms to put their customers’ needs first and provide clear communication and support.

Are your team trained to spot those in financial difficulty?

- Due to the cost of living crisis, this group will become much larger – putting even more pressure on teams.

- Make sure teams aren’t just dealing with the request in front of them but are also thinking about the customer as a whole. For example, forecasting cash flow issues to ensure someone can pay for something in future and working that into customer support conversations.

Are customers having to repeat themselves?

- It can be difficult for customers to open up to an agent, so being transferred and repeating themselves to multiple agents can stress out vulnerable customers.

- Make sure call information is captured in one system so different departments and agents have one version of truth.

Is your customer support proactive?

- Instead of waiting for customers to come to you, proactively contact customers who may be dissatisfied or having problems.

- Unexpectedly calling or messaging shows customers you are honest and upfront, reassuring them that something is being done and you care.

- For example, check in with customers before their next bill even if it’s just a WhatsApp, email or text message to inform them the next payment is coming up and ask if everything is ok, if they can meet this payment or if they need to have a conversation around payment – this is helpful support for people who have habitual struggles with payment.

3. Get the right tech in place

Leveraging technology allows agents to spot trends in customer conversations and enhances training and coaching, allowing staff to make more informed decisions when supporting customers.

Have you got interactive scripting guides for teams to follow?

- Having scripts and guides within your software can help agents to lead the conversation, but it’s important it doesn’t become a “one size fits all” templated response. Include information on where agents can point customers to if escalation is needed e.g. relevant charity support.

- Let agents know the areas where they can / can’t help, and where their role ends.

Do you offer the right communication channels?

- Different customers have different needs and preferences – offer phone, text, email, webchat.

- Phone lines are still vital – 50% of those aged 75+ have no online access.

- People might also find it easier to open up on webchat/SMS as they can share their difficulties without feeling as if they’re being judged. However, you miss verbal cues and tone – so teams need to be careful in how they respond and make sure this is interpreted correctly.

- Being able to write down thoughts in an email can also allow customers to methodically structure what they want to say and gives agents time to read and digest the information, as well as keep some emotional distance.

- Even if conversations start in text form, it’s important to try to get that person onto a phone call as quickly as possible where nuance and tone can be captured.

Do you have speech analytics in place?

- A modern speech analytics platform doesn’t just capture the words spoken, it can capture HOW they are spoken. For example, highlighting uncertainty in a customer response.

- The software automatically identifies these potentially vulnerable customers so that the business can track them and take further action if necessary.

Discover how speech analytics can turn conversation into insights here >

4. Support front-line staff who are dealing with calls

Nearly three-quarters (72%) customer-facing staff say they’re burnt out or facing burnout due to increased workload. And for those speaking to vulnerable customers this pressure is even greater – which is why supporting staff is key to supporting vulnerable customers.

Image stat, text: 72% of customer-facing staff say they’re burnt out or facing burnout

Can you instantly access call recordings?

- If an agent has a difficult call, team leaders should be able to instantly access call recordings to make sure they have all the information they need to empathise and support agents when they ask for support.

- But it’s not just calls. Live monitoring of conversations across SMS, web chat and email allows leaders to provide actionable feedback and coaching to teams and individuals.

Do you have peer support groups?

- Give agents self-learning time where they can gather to vent and discuss how to deal with difficult calls. For example, accessing historical recordings and chats, listening to and analysing previous conversations together and reviewing best practices.

- Allow team leaders to listen in and understand the challenges staff face, especially in a remote environment.

Are the right agents dealing with the right calls?

- Back-to-back calls with distressing situations can really take their toll – especially if the right people haven’t received extensive training in that area.

- Giving the right conversations to the right agents means they can handle calls more effectively and feel confident in their job.

Are managers live tracking sentiment?

- Allowing team leaders to listen into calls can help with QA, but also allows you to identify agents who need extra guidance.

- Live-tracking call sentiment allows them to pinpoint which calls, customers and agents need the most support.

5. Don’t let support become counselling

The cost of living crisis has led to a surge in customers seeking support and reassurance, but it’s important to remember that agents aren’t counsellors and shouldn’t be taking on the additional emotional burden. Agents who are dealing with upsetting calls need to be supported and clear on the areas where they can provide support and where to signpost vulnerable customers for extra help.

Do agents know where their role ends?

- Calls with vulnerable customers can be very emotionally charged and agents often want to do everything they can to help.

- Ensure guides and scripts explain where their role ends and when they should flag to a supervisor or charity who are better qualified to help.

- This creates better outcomes for both agents and customers.

Are people getting breaks between difficult calls?

- The last thing you want is agents feeling horrific after a bad call – make sure that they feel supported.

- Allow them to have 5-10 mins breaks after distressing calls so they can recap, regroup and rethink – getting them into the right mindset for the next customer.

Do you have break clauses in place?

- Once people open up about an issue, a customer service agent might be the first person they’ve spoken to about it – and you can’t stop them in mid flow.

- Supervisor / managers need to put rules in place to catch this. For example, if a call is longer than 30mins, managers should check in to see whether the agent needs help, and be on hand to support that agent if they’re dealing with an emotionally draining situation.

- Especially working remotely, managers can make sure that person gets a break after a particularly demanding call, or can speak to a mental-health advisor.

Improve the outcomes for distressed and vulnerable customers

Now more than ever, you need to ensure that distressed and vulnerable customers can receive the right support from your contact centre teams. While making sure your agents and advisors have the right training and tools to deal with those potentially difficult and distressing conversations.

Book a customised demo to learn how our contact centre software can help your contact centre teams serve vulnerable customers more effectively.