In an era where customer interactions can make or break a business, understanding the pulse of contact centre operations has never been more crucial. That’s why we’ve conducted an extensive survey of 500 UK contact centre leaders, spanning various sectors and organisation sizes, to bring you our 2024 Industry Benchmark Report.

This comprehensive study delves into the heart of contact centre operations, examining key performance indicators, emerging trends, and the challenges faced by industry professionals. From sales strategies to debt collection tactics, customer experience initiatives to agent performance metrics, our report offers a panoramic view of the current landscape. Whether you’re looking to optimise your sales approach, enhance your customer service, or improve your debt collection processes, the insights gleaned from this study will provide valuable benchmarks and actionable intelligence.

Sales Benchmarking

In the realm of contact centre sales, our findings reveal a sector striving for efficiency and effectiveness in an increasingly challenging market.

Key findings:

- Average daily calls per agent: 65.55

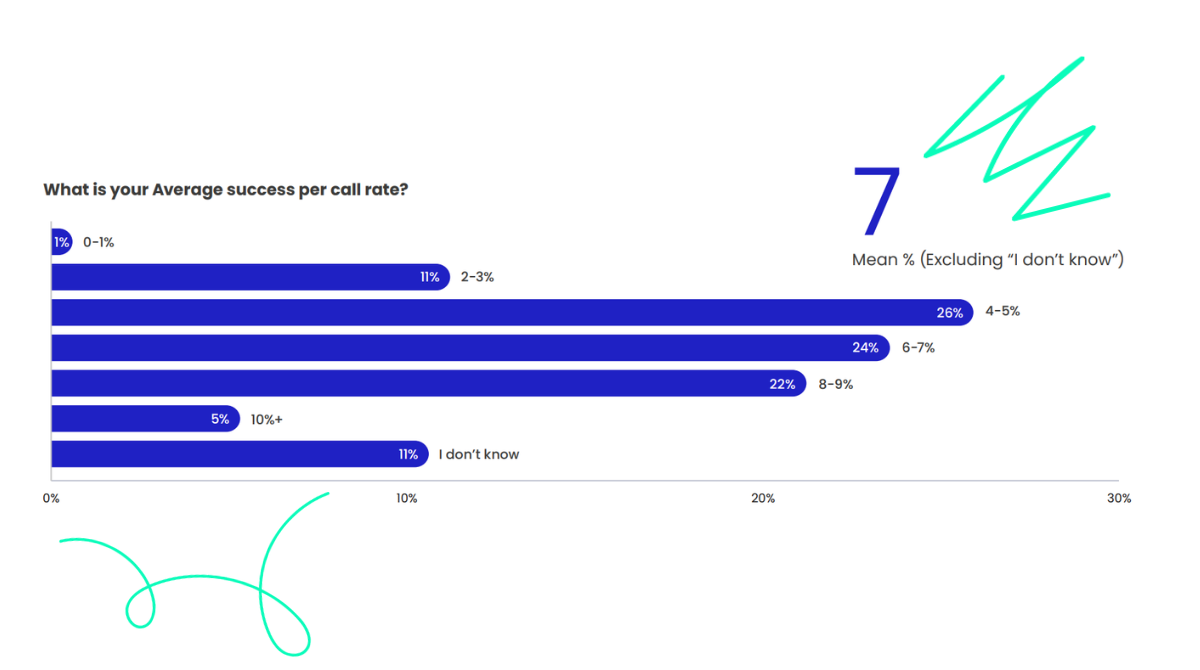

- Mean success per call rate: 6.74%

- Average first-call close rate: 27.81%

- Mean average revenue per call: £197.60

The average number of daily calls per agent stands at an impressive 65.55, with half of the sales teams managing between 31 and 60 calls per agent per day. This high volume of calls underscores the importance of streamlined processes and effective time management in today’s fast-paced sales environment.

What’s particularly encouraging is the mean success per call rate of 6.74%. This figure suggests that most of our respondents are working with qualified leads rather than relying on cold calling, which typically yields much lower success rates. It’s a testament to the growing sophistication of lead generation and qualification processes in the industry.

The average first-call close rate of 27.81% further emphasises this point, with nearly 30% of teams achieving rates between 20% and 29%. This metric not only reflects the quality of leads but also speaks volumes about the skill and preparation of sales agents. It highlights the value of thorough training and the importance of equipping agents with the right tools and information to close deals efficiently.

However, when it comes to revenue generation, there’s a notable disparity among teams. While the mean average revenue per call is £197.60, nearly a quarter of teams are generating between £30 to £59 per call. This variance suggests there’s significant room for improvement in upselling and cross-selling strategies for many contact centres. It also points to the potential benefits of focusing on high-value products or services to boost overall revenue.

Debt Collection Benchmarking

The debt collection sector faces unique challenges, especially in the current economic climate. Our findings provide a nuanced picture of how debt collection teams are performing in this demanding environment.

Key findings:

- Mean Right Party Contact (RPC) rate: 26%

- Average Promise to Pay (PTP) rate: 29%

- Mean percentage of debt collected: 32%

- Average First Call Resolution (FCR) rate: 42.83%

The mean Right Party Contact (RPC) rate of 26% indicates that debt collection teams are making headway in reaching the correct individuals, but there’s still considerable room for improvement. Enhancing this metric could significantly boost overall collection efficiency, potentially through better data management and intelligent dialling strategies.

When it comes to securing commitments, the average Promise to Pay (PTP) rate of 29% shows promise, with over half of the teams achieving rates between 20% and 39%. This suggests that once contact is made, agents are relatively successful in negotiating payment arrangements. However, pushing this rate higher could dramatically improve collection outcomes.

Perhaps the most encouraging statistic is the mean percentage of debt collected, standing at 32%. This figure outperforms the average US rate of 20% to 30%, indicating that UK debt collection teams are relatively effective in their collection efforts. However, it also suggests that there’s potential to recover an even greater proportion of outstanding debts.

The average First Call Resolution (FCR) rate for debt collection at 42.83% is a positive sign, showing that many issues are being resolved efficiently. However, increasing this rate could lead to faster resolutions and improved customer satisfaction, even in challenging circumstances.

Contact Centre Agent and Team Benchmarking

Our findings on agent and team performance reveal a sector in flux, adapting to new working models while grappling with perennial challenges.

Key findings:

- 66.2% of agents work in a hybrid environment

- Average annual agent turnover rate: 30.2%

- 43.8% of contact centres increased agent salaries (average increase: 7.14%)

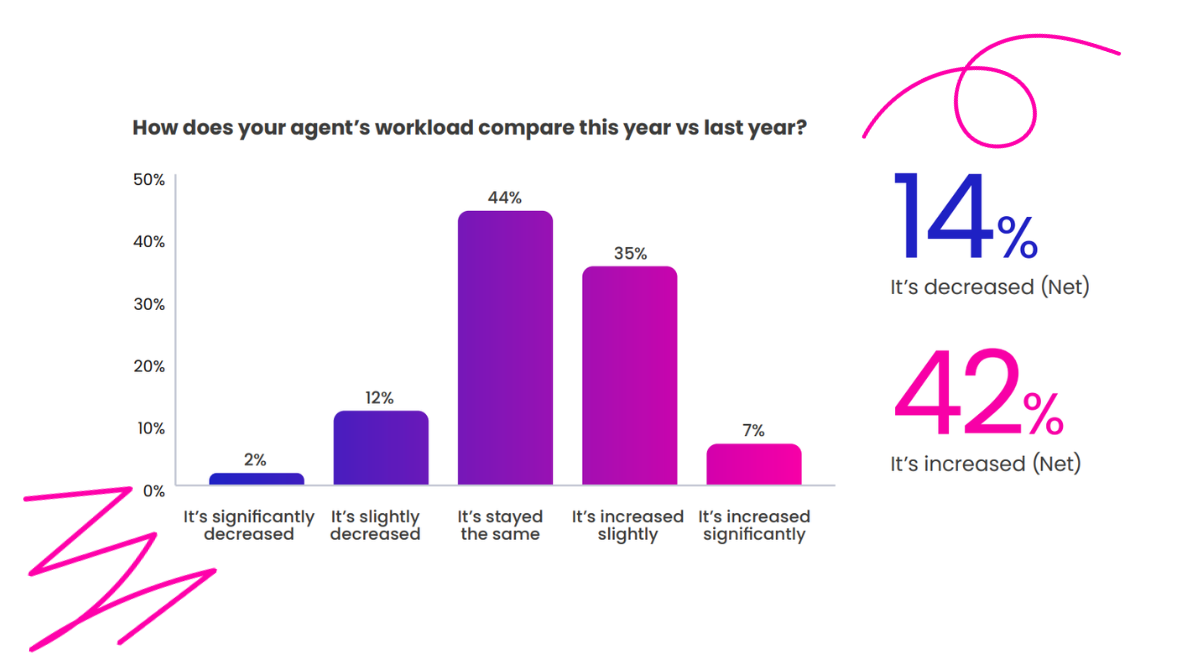

- 42.0% of contact centres reported increased agent workload (average increase: 10.87%)

The shift towards hybrid working is clear, with 66.2% of agents now working in a hybrid environment and less than a quarter (23.2%) working fully in-office. This transition brings both opportunities and challenges, requiring contact centres to adapt their management and communication strategies to ensure consistency and quality across different working environments.

The average annual agent turnover rate of 30.2% remains a concern, highlighting the ongoing challenge of retention in the industry. This high churn rate can lead to increased training costs, reduced efficiency, and potential impacts on customer experience. Addressing this issue through improved working conditions, career development opportunities, and employee engagement initiatives should be a priority for many contact centres.

On the compensation front, 43.8% of contact centres reported an increase in agent salary compared to last year, with an average increase of 7.14%. This suggests that many organisations are recognising the need to offer competitive salaries to attract and retain talent. However, it’s worth noting that over half of the contact centres surveyed didn’t report a salary increase, which could potentially exacerbate retention issues.

Perhaps most concerningly, 42.0% of contact centres reported an increase in agent workload compared to last year, with an average increase of 10.87%. This significant uptick in workload, if not managed carefully, could lead to burnout, decreased job satisfaction, and ultimately, higher turnover rates.

Customer Service Benchmarking

In an age where customer experience can be a key differentiator, our findings reveal a sector that’s performing well but still has room for improvement.

Key findings:

- Mean call abandonment rate: 4.41%

- Average speed of answer: 17.11 seconds

- Mean Average Handle Time (AHT): 7.82 minutes

- Average First Call Resolution (FCR) rate: 41%

The mean call abandonment rate of 4.41% is relatively low, with over half of teams achieving rates between 2% and 5%. This suggests that most contact centres are managing their call volumes effectively, preventing customer frustration due to long wait times. However, striving to reduce this rate further could significantly enhance customer satisfaction.

When it comes to responsiveness, the average speed of answer stands at 17.11 seconds. While this isn’t a poor performance, it’s worth noting that a quarter of teams are managing to answer calls between 6 and 10 seconds. This faster response time could be a goal for other contact centres to aspire to, as quick answers can dramatically improve customer perceptions.

The mean Average Handle Time (AHT) of 7.82 minutes, with 44% of teams reporting times between 6 and 9 minutes, indicates a balance between efficiency and thoroughness. However, it’s crucial to remember that AHT should always be considered alongside other metrics like customer satisfaction and first call resolution to ensure quality isn’t sacrificed for speed.

Speaking of First Call Resolution (FCR), the average rate for customer service stands at 41%. While this isn’t a poor figure, there’s certainly room for improvement. Boosting FCR rates can lead to increased customer satisfaction, reduced workload, and lower operational costs.

Charting the Course for Contact Centre Success

As we reflect on the findings of our 2024 Industry Benchmark Report, it’s clear that UK contact centres are navigating a complex and evolving landscape with resilience and adaptability. While there are many positives to celebrate – from impressive sales metrics to above-average debt collection rates – there are also clear areas for improvement across all sectors.

There are several challenges facing contact centres in the coming years: balancing efficiency with quality customer experiences, managing the transition to hybrid working models, addressing retention issues, and leveraging new technologies like AI and speech analytics to enhance performance. However, these challenges also present opportunities for forward-thinking contact centres to differentiate themselves and achieve new heights of success.

By focusing on key performance indicators, investing in agent wellbeing and development, and embracing innovative technologies, contact centres can enhance their operations, improve customer satisfaction, and drive business growth. The benchmarks provided in this report offer a valuable starting point for organisations looking to assess their current performance and set ambitious yet achievable goals for the future.

As we move further into 2024 and beyond, the contact centre industry will undoubtedly continue to evolve. Those who stay informed, remain agile, and consistently strive for improvement will be best positioned to thrive in the forever changing contact centre environment. At MaxContact, we’re committed to supporting this journey, providing the tools, insights, and support needed to turn these benchmarks into stepping stones for success.

The full “2024 UK Contact Centre KPI Benchmarking Insights Report” is available for download here.